President slaps new 10% tariff on BRICS countries

The United States is close to finalizing several trade pacts in coming days and will notify other countries of higher tariff rates by July 9, President Donald Trump said on Sunday, with the higher rates set to take effect on August 1.

Since taking office, Trump has set off a global trade war that has roiled financial markets and sent policymakers scrambling to protect their economies, through efforts such as deals with the United States and other countries.

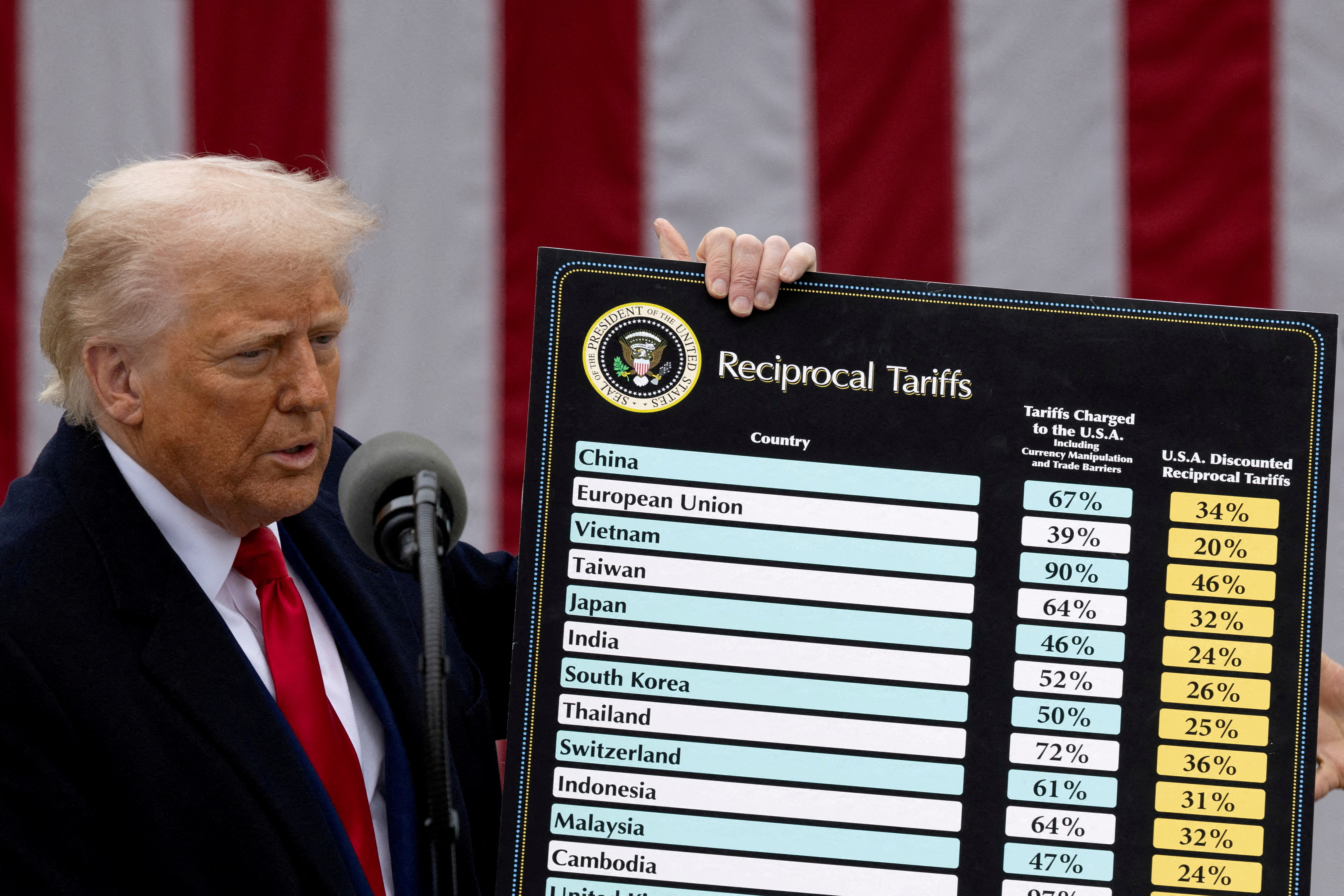

In April Trump unveiled a base tariff rate of 10% on most countries and additional duties of up to 50%, but later gave a three-week reprieve until Wednesday for all but 10% of them.

Trump, whose remarks to reporters on Sunday came just before his return to Washington from a weekend golfing in New Jersey, had flagged the August 1 date earlier, but it was unclear if all tariffs would increase then.

Asked to clarify, Commerce Secretary Howard Lutnick told reporters the higher tariffs would take effect on August 1, but Trump was “setting the rates and the deals right now.”

In a posting on his Truth Social website, Trump later said the U.S. would start delivering tariff letters from 12:00 pm ET (1600 GMT) on Monday.

State of play as tariff deadline nears

Here’s the state of play for several U.S. trading partners facing deadlines this week:

EUROPEAN UNION

U.S. officials said they were making good progress with the 27-member European Union, after its top trade negotiator Maros Sefcovic met with officials in Washington last week. EU diplomats said talks were continuing but they had not achieved a breakthrough as of Friday.

One EU diplomat said the bloc’s regulations on social media and other technology companies, stricter than those in the U.S., were not up for negotiation, and a 17% tariff proposed by the U.S. side on agriculture and food exports remained a big hurdle.

EU officials have said they are open to a U.S. deal that would apply a universal 10% tariff on many of its exports, but want to secure exemptions from sectoral tariffs already in place or planned for pharmaceuticals, alcohol, semiconductors, and commercial aircraft, Bloomberg reported.

The EU is also pushing for U.S. quotas and exemptions to effectively ease Washington’s 25% tariff on automobiles and auto parts, as well as its 50% tariff on steel and aluminum, the report said, citing people familiar with the matter.

JAPAN

Japan says it is continuing to seek an agreement with the U.S. while defending its national interest. Japan’s tariff negotiator Ryosei Akazawa held “in-depth exchanges” over the phone with U.S. Commerce Secretary Howard Lutnick on Thursday and Saturday, the Japanese government said.

The discussions came after Trump this week hammered Japan over what he said was Tokyo’s reluctance to import U.S.-grown rice, and accusing Japan of engaging in “unfair” autos trade. He has also called on Japan to import more U.S. oil.

On Monday, Trump said Japan could be among those receiving a tariff letter, and suggested it could face duties of up to 35%.

INDIA

Trump has long promised a trade deal with India, but talks have stalled on disagreements over U.S. tariffs on auto components, steel and agricultural goods.

India, which is facing 26% tariffs on its exports to the U.S., has signaled it is ready to slash its high tariff rates for the U.S. but has not conceded on Washington’s demands for opening up the agriculture and dairy sectors.

On Friday, New Delhi also proposed retaliatory duties against the U.S. at the World Trade Organization, saying Washington’s separate 25% tariff on automobiles and some auto parts would affect $2.89 billion of India’s exports.

INDONESIA

Indonesia has offered to cut duties on key imports from the United States to “near zero” and to buy $500 million worth of U.S. wheat as part of its tariff talks to avert a 32% tariff rate. State-owned carrier Garuda Indonesia GIAA.JK also plans to buy more Boeing planes as part of a $34 billion pact with U.S. partners due to be signed this week.

Accused by some other countries of excessive red tape, Indonesia eased import licensing requirements for some goods and waived import restrictions on plastics, chemical products and other industrial raw materials on June 30, a goodwill gesture ahead of the July 9 deadline. Indonesia has also invited the U.S. to jointly invest in a state-owned Indonesian minerals project as part of its tariff negotiations.

SOUTH KOREA

Despite frequent rounds of talks and some preliminary agreements, South Korea had said it would seek an extension on Trump’s July 9 deadline, although talks will continue this week.

Wi Sung-lac, President Lee Jae Myung’s national security adviser, plans to visit Washington during July 6-8 to discuss a range of bilateral issues. The country’s trade minister, Yeo Han-koo was also due to meet with U.S. Trade Representative Jamieson Greer and other U.S. officials.

South Korea already imposes virtually no tariffs on U.S. imported goods under a free-trade agreement, and so the U.S. has focused on other issues, including foreign exchange rates and defense costs. Trump often complains about the cost-sharing arrangement for the 28,500 U.S. troops stationed in South Korea.

THAILAND

Thailand is making a last-ditch effort to avert a 36% tariff by offering greater market access for U.S. farm and industrial goods, along with increased purchases of U.S. energy and Boeing BA.N jets, Finance Minister Pichai Chunhavajira told Bloomberg News on Sunday.

Thailand’s proposals have included reducing its own tariffs, purchasing more American goods and increasing investments.

Thailand’s initial proposal included measures to enhance market access for U.S. exports and tackle transshipment violations, as well as Thai investment that would create U.S. jobs. Bangkok said also pledged to import more U.S. natural gas and cut tariffs on imports of corn from the United States.

SWITZERLAND

Switzerland is exploring what concessions it can make to avert a 31% tariff rate on goods it ships to the U.S., including granting the U.S. greater market access for produce like seafood and citrus fruits.

But as home to pharmaceutical giants Roche and Novartis, both big U.S. investors, Switzerland also wants assurances that it can avert pharmaceutical tariffs that Trump has threatened to impose at a later date.

In a separate post, he rolled out a wholly new tariff policy, calling for countries “aligning themselves with the Anti-American policies” of the BRICS developing nations to be charged an extra 10% tariff, with no exceptions to be granted.

The first BRICS summit in 2009 was attended by leaders from Brazil, China, India and Russia, with South Africa joining later while Egypt, Ethiopia, Indonesia, Iran, Saudi Arabia and the United Arab Emirates were included last year.

Trump has close ties to leaders of some of those countries, such as Saudi Arabia and UAE, and has been touting the prospect of a trade deal with India for weeks.

On Sunday, BRICS leaders condemned attacks on Gaza and Iran, called for reforms to global institutions and warned that the rise in tariffs threatened global trade.

It was not immediately clear if Trump’s tariff threat would derail trade talks with India, Indonesia and other BRICS nations, however.

Earlier on Sunday, U.S. Treasury Secretary Scott Bessent told CNN’s “State of the Union” that several big trade agreements would be announced in the next days, adding that European Union talks had made good progress.

Trump would also send letters to 100 smaller countries with which the United States does not have much trade, notifying them of higher tariff rates, he added.

“President Trump’s going to be sending letters to some of our trading partners saying that if you don’t move things along, then on August 1 you will boomerang back to your April 2 tariff level,” Bessent said.

“So I think we’re going to see a lot of deals very quickly.”

Kevin Hassett, who heads the White House National Economic Council, told CBS’s “Face the Nation” program there might be wiggle room for countries engaged in earnest negotiations.

“There are deadlines, and there are things that are close, and so maybe things will push back past the deadline,” Hassett said, adding that Trump would decide.

‘I HEAR GOOD THINGS’

Stephen Miran, chairman of the White House Council of Economic Advisers, told ABC News’ “This Week” program that countries needed to make concessions to get lower tariff rates.

“I hear good things about the talks with Europe. I hear good things about the talks with India,” Miran said. “And so I would expect that a number of countries that are in the process of making those concessions … might see their date rolled.”

Bessent told CNN the Trump administration was focused on 18 important trading partners that account for 95% of the U.S. trade deficit. But he said there had been “a lot of foot-dragging” among countries in finalizing trade deals.

Thailand, keen to avert a 36% tariff, is now offering greater market access for U.S. farm and industrial goods and more purchases of U.S. energy and Boeing BA.N jets, Finance Minister Pichai Chunhavajira told Bloomberg News on Sunday.

India and the United States are likely to make a final decision on a mini trade deal in the next 24 to 48 hours, local Indian news channel CNBC-TV18 reported on Sunday, with average tariffs of 10% on Indian goods shipped to the U.S., it said.

Hassett told CBS News that framework agreements already reached with Britain and Vietnam offered guidelines for other countries. He said Trump’s pressure was prompting countries to move production to the United States.

The Vietnam deal was “fantastic,” Miran said.

“It’s extremely one-sided. We get to apply a significant tariff to Vietnamese exports. They’re opening their markets to ours, applying zero tariff to our exports.”

Click here to change your cookie preferences