The Bank of Cyprus‘ property management unit has achieved a significant turnaround in its non-core asset portfolio, announcing that property sales have exceeded new asset acquisitions since the start of 2019, as part of its financial results for the nine-month period ending September 30, 2025.

The Real Estate Management Unit (REMU), which concentrates on liquidating properties acquired through debt-for-asset swaps, has achieved approximately €1.3 billion in recovered asset sales since 2019.

This figure vastly surpasses the €0.5 bn in properties the bank took over during the same timeframe.

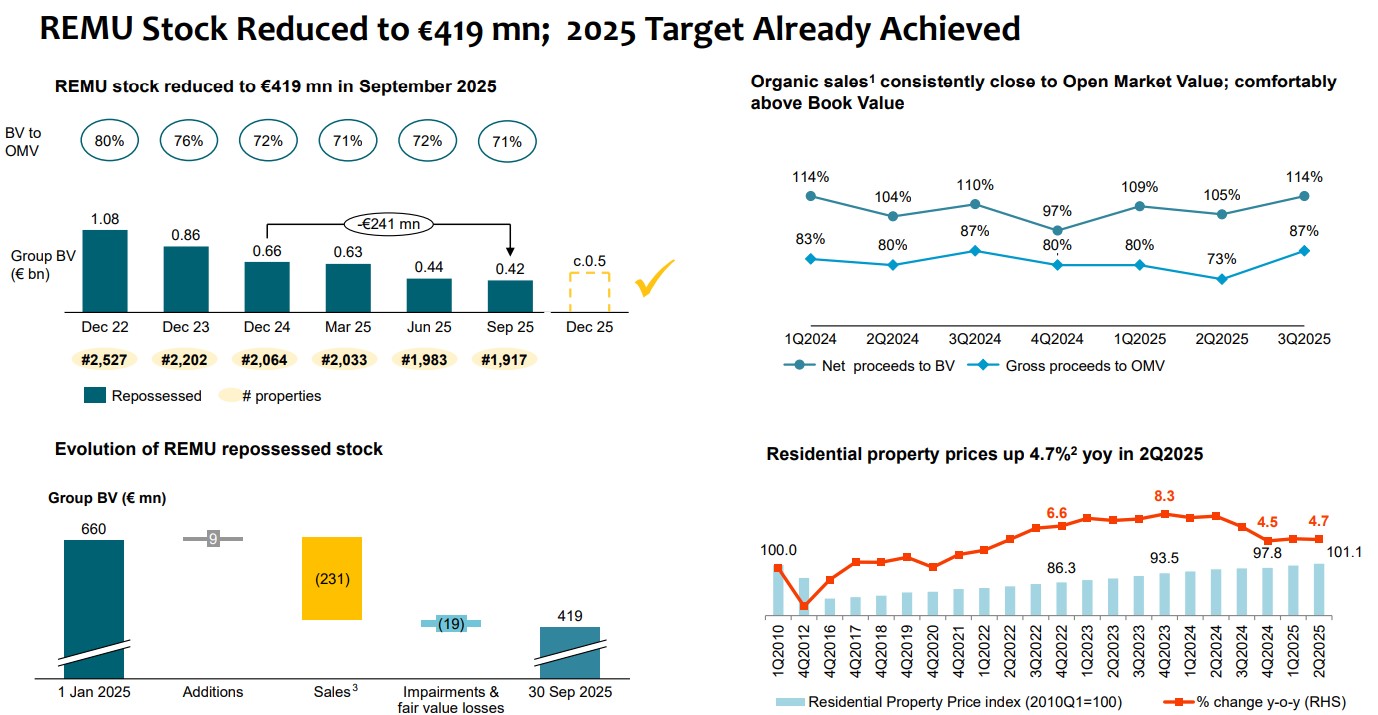

In the nine months to September 30, 2025, the unit concluded property sales totalling €231 million, which is a sharp increase compared to the €82 million in sales (including transfers) recorded in the corresponding nine-month period of 2024.

Profit from these sales also saw a substantial rise, reaching approximately €10m in the 2025 period, nearly double the €5m profit achieved in the equivalent period in 2024.

However, in its financial results, the bank also warned that “REMU profits remain volatile“.

The asset sales covered all property categories, with roughly 40 per cent of the gross value of sales in the period ending September 30, 2025, concerning land.

The unit executed sales agreements for 289 properties during the nine months, with a contractual price of €250m.

This compares to the equivalent 2024 period, when sales agreements were signed for a higher volume of 367 properties, but for a lower contractual price of €94m (including a €3m transfer).

Furthermore, REMU had advanced sale procedures for properties at a contractual price of €26m as of September 30, 2025, with €14m of that total relating to signed sales agreements.

This contrasts with €53m in advanced sales procedures on September 30, 2024, of which €27m involved signed agreements.

Regarding the intake of new assets, the unit took over properties valued at €9m in the nine-month period of 2025 through debt-for-asset swaps and recovered assets, representing a significant drop from the €28m in additions recorded in the parallel 2024 period.

The net book value of recovered properties managed by the unit stood at €419m on September 30, 2025.

This marked a 45 per cent annual reduction from €764m on September 30, 2024, and a decrease from €442m on June 30, 2025, primarily reflecting a major asset disposal completed by the unit in June 2025.

The unit has already met its goal of reducing this specific portfolio to around €0.5 bn by the end of 2025.

Click here to change your cookie preferences