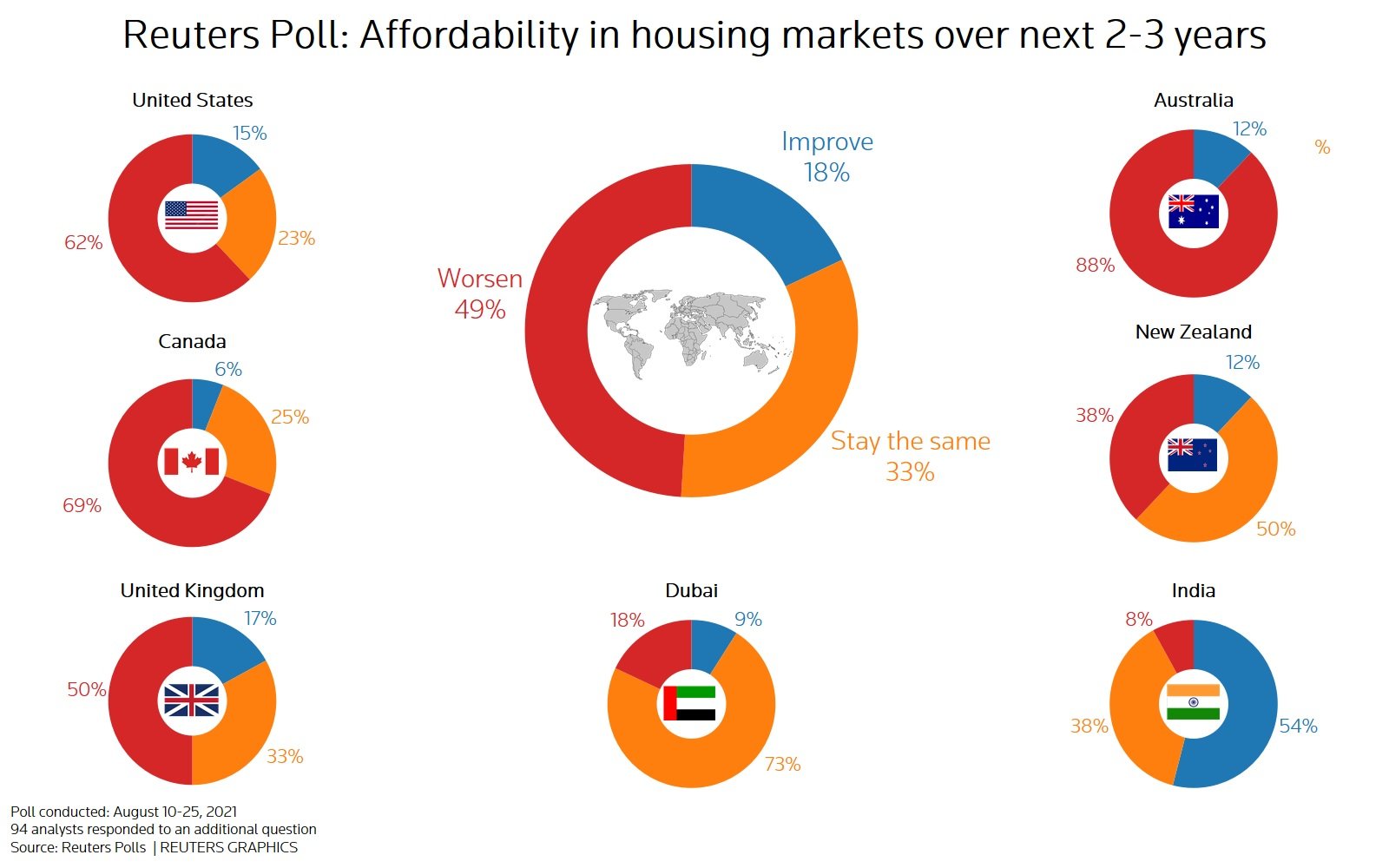

The sizzling pace of house price rises in most major world housing markets since the pandemic began has likely peaked, but affordability is set to remain stretched or worsen in the next few years, according to Reuters polls of experts.

Reuters polls of over 100 property market experts taken Aug. 10-25 covering eight key markets – the US, Canada, Britain, India, Australia, New Zealand, China and Dubai – mostly showed price rises would cool over the next two years.

But with most central banks expected to keep rates near record lows through next year, house price inflation is still expected to easily outstrip wage gains.

Taken together with rising materials costs – and a lack of supply of affordable homes in many markets even before the pandemic drove many homeowners to search for more living space – home prices are nearly certain to rise further.

That means for most, especially young people who are looking to buy their first home, it is only going to get tougher.

“The surge in home prices has wiped away the gains in affordability brought on by lower interest rates, causing many would-be home buyers to put off buying,” said Mark Vitner, senior economist at Wells Fargo.

“We are forecasting housing market activity to settle into a more sustainable pace over the next 18 months, with some payback from home sales that were likely pulled forward during the pandemic.”

If that is true, the trend is not set to ease in coming years until more homes are built. But even with the current low rates of homebuilding in most markets, building material, labour and lumber costs are more likely to rise than fall.

House prices in the United States, Canada, Australia and New Zealand were predicted to rise in double-digits this year and then slow to single digits in 2022.

Apart from Dubai, house prices in the US, Canada, UK, India and Australia were rated above 5, where 1 was cheap and 10 is expensive, with New Zealand rated 9, suggesting residential properties there were beyond reach for first-time buyers.

Eighteen analysts said a slowdown in economic growth, five said supply chain disruption, four said high unemployment and only two said returning to a full-time work week was the biggest downside risk to the housing market over the next 12 months.

“Home prices appreciation will moderate fast, but wage growth will not compensate for the fading government emergency programs,” said Sebastien Lavoie, chief economist at Laurentian Bank.

“A new variant reducing vaccine efficacy could force authorities in North America to re-introduce broad lockdown measures, bringing more permanent layoffs than in previous pandemic waves. Slowdown in economic growth is also another important downside risk.”

Click here to change your cookie preferences