This article summarises the discussion Forum organised by the Cyprus Economic Society on 14 October 2021 on the German Elections and What it Means for Europe. The speaker was Dr Christian Odendahl, Chief Economist of the Centre for European Reform. This summary was based on a transcript of the discussion and was prepared by Ioannis Tirkides and Andreas Charalambous of the Cyprus Economic Society.

The presentation from Christian Odendahl and the discussion that followed focussed on German domestic politics, the debate on fiscal policy in Germany and the EU, fundamental shifts in EU policies and further integration, and also on the evolving geopolitics and their implications for Germany and for Europe.

Germany is widely regarded as seeking consensus and favouring stability. Climate change and the new geopolitical realities are perceived as the primary challenges that need to be addressed collectively by the EU. Unity will be needed to defend Europe’s geopolitical place in the world. This changes the dynamics for crisis management and further integration in the EU. A stronger and more united Europe will be in the interests of all member countries, and certainly Germany’s.

German elections

The German elections that took place in September 2021, were of particular importance because it was the first time in 16 years that Angela Merkel was not a candidate. After a long chancellorship, Angela Merkel stepped down with an unprecedented approval rating of 80 per cent. The search for her successor was driven by a desire for continuity, which gave rise to the unusually large swings observed in the polls prior to the election. The lead passed from the Greens initially, to the Christian Democrats, and finally to the Social Democrats.

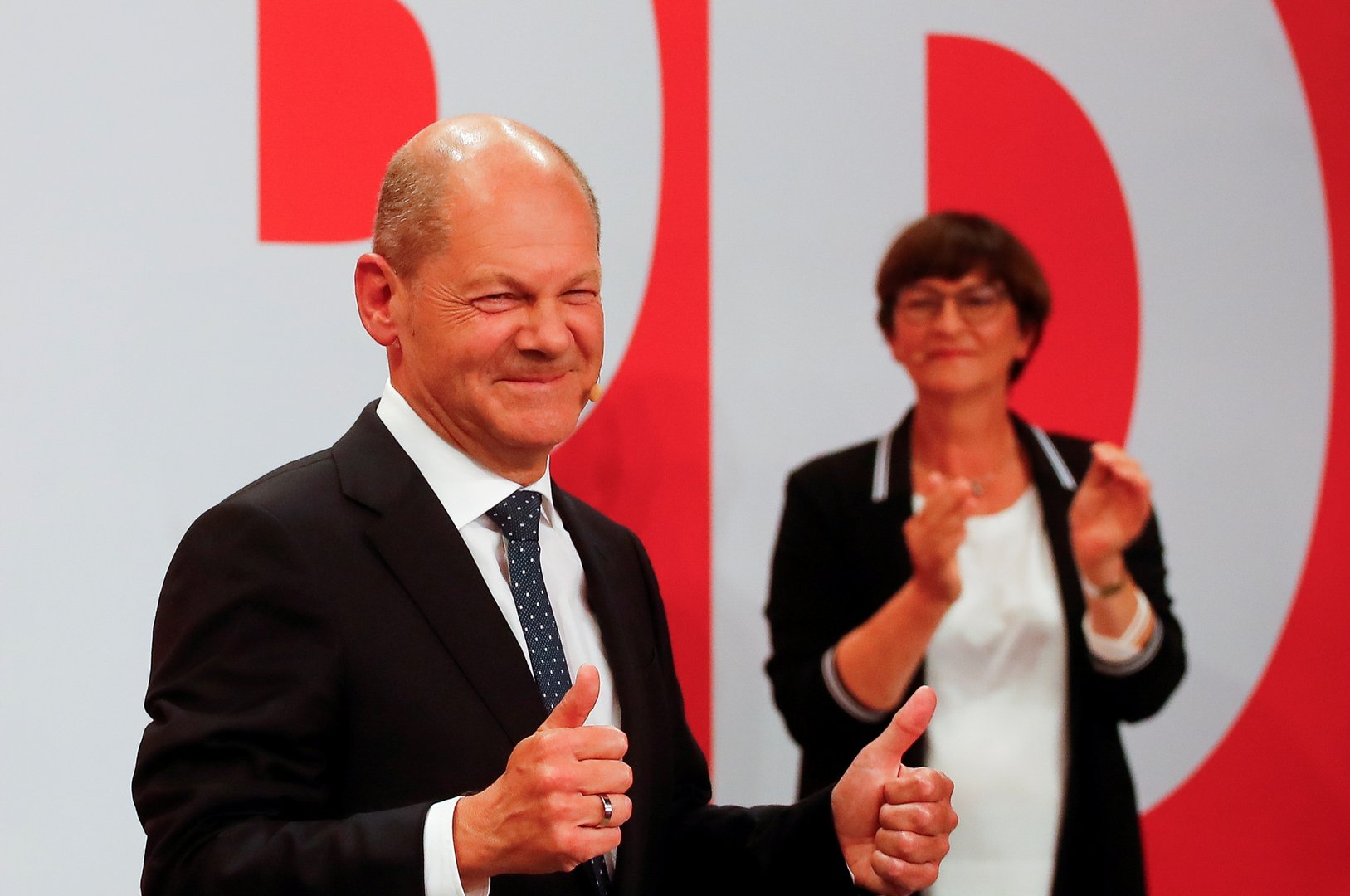

The Social Democrats won in the end with a modest majority of 25.7 per cent of the vote followed by the Christian Democrats with 24.1 per cent of the vote and the Greens with 14.8 per cent. There are two main reasons why the Social Democrats topped the results. First, they adopted a relatively consistent, social democratic oriented policy platform, and were not afraid to take a firm stance on politically sensitive issues, like the minimum wage or social housing policy. The second reason, and even more important, was the personality of Olaf Scholz himself. An experienced politician, and member of Angela Merkel’s coalition government, he inspired more confidence that the challenges facing Germany and the European Union will be administered effectively, while safeguarding continuity.

The Social Democrats and the Greens presented political programs that were relatively close making a coalition between them relatively easier. The Free Democrats by contrast, are a centre right liberal party with a tough agenda on fiscal discipline. They campaigned for tax cuts and adherence to the German fiscal rules. A coalition government by these three parties requires difficult compromises, which means there must be concessions, primarily in favour of the Free Democrats.

The Green party makes a difference in German politics, and in this election in particular. In contrast with other green parties in Europe, the German Green party is more centrist, firmly rooted in the German political spectrum, while at the same time having preserved its somewhat more imaginative or creative political approach. For example, some of the most progressive and modern internationalist views on defence and security have come from the Greens, who started out as a peace movement against NATO. On fiscal policy as well, the Greens have been the most progressive, arguing that the fiscal brake as currently in place , doesn’t serve Germany well and needs to be reformed.

The debt brake, which is part of the budget framework, embedded in the German constitution, is a point of disagreement among the current coalition parties. It was enacted in 2009 when the debt-to-GDP ratio exceeded the 60 per cent threshold of the Maastricht Treaty. The Free Democrats oppose a reform of the debt brake, which could constrain the ability to fund the ambitious new government social spending programs and green investments.

But in practice there can be ways around this constraint. Under the German rules, separate so-called shadow budgets can be established or utilized, which under certain circumstances will not count toward the debt brake, notably when they adhere to the so called private investment principle, meaning that they would qualify as investments from a private sector point of view. For example, if KfW, the state-owned investment and development bank, undertakes a capital increase, to raise cash for subsidised loans to the private sector, then the debt created, will not count towards the German debt brake. To this end, some already established reserve funds that existed can be utilized.

The fiscal debate in Germany

Importantly, the fiscal debate in Germany has changed considerably during the last years, for a number of reasons. First, the experience of the previous ten years as such, when market interest rates dropped to negative territory, made public debt less of a concern in the eyes of the electorate. Second, the euro crisis, which was a main concern in the previous decade, has abated, and the euro has stabilised.

Also, two other issues have come to the forefront that also worked to change the fiscal debate, namely climate and geopolitics. Climate change has become the top concern in German politics, and this is an area that will require a lot of investment, public and private, which will not be possible under a strict fiscal regime.

Secondly, the geopolitics of Europe and also Germany’s have changed. In 2010, the relationship between Europe and the United States was stable and Brexit was not on the table.

Also, Russia and Turkey did not pose the challenges they pose today. Then, a number of events shaped the geopolitical scene: in 2014 Russia invaded Ukraine and in 2016 the Brexit referendum in the UK and the election of Trump as President in the US took place. The UK has left the EU, and the US geopolitical rivalry with China intensified considerably. As a consequence, the world changed, leading to an increased awareness in Europe that it must rely more on its own strength.

The fiscal debate in Europe

Regarding fiscal policy in the EU, there is increasing awareness that going back to the rules prior to the pandemic would be highly problematic. But there is no consensus as to how these rules must change. For some northern core countries, weakening the fiscal rules after agreeing to the recovery fund, will be hard to sell to their domestic electorates.

At the same time, there is broad awareness that the fight against climate change will require a lot of additional investment in all countries, which cannot happen under an austerity driven fiscal framework. The critical issue for the European fiscal framework, is how to make sure that the new rules do not force austerity in countries such as Italy that now have a debt level that is more than two and a half times more than the Maastricht limit of 60 per cent of GDP and other countries such as Spain, Portugal, Greece and Cyprus. The debate on this subject, on how to re-apply the rules, is still at its early stages.

Banking union

On the banking union, there is little political support in Germany, because it is perceived as a risk transfer to Germany. Olaf Scholz in his time as finance minister, put out a white paper on how a banking union could move forward in a very gradual and cautious manner. The basic idea was to proceed sequentially, first promoting effective risk reducing measures in the banking sector, thus addressing the vulnerabilities of the banking sector in the EU, before taking steps towards a common deposit insurance. This offers some possibilities for a political agreement on this hot subject, but in the current coalition government of three parties in Germany, the appetite for taking up the completion of the banking union is rather limited.

Eurozone stability

On Eurozone stability, the pandemic has provided two very useful tests. The first, is that, in a severe crisis, an ad hoc fiscal insurance mechanism can be put in place, one that need not be rules based. In the severe crisis caused by the pandemic, the financially robust Northern countries, Germany in particular, also in agreement with France, established such an ad hoc fiscal insurance mechanism, in the “Recovery and Resilience Fund”.

A similar response can now be expected if similar situations emerge in the future.

Second, since Mario Draghi’s ‘whatever it takes’, the ECB is de facto the lender of last resort to governments. Markets are convinced that this radical shift is credible, which led to a radical change of how Germany, France and other countries collectively view their responsibility for the eurozone and the tools to ensure its stability.

The pandemic provided the first proper test for the ECB as the de facto lender of last resort. In April 2020, at the beginning of the pandemic, the government spreads were rising in countries perceived by markets as vulnerable. When Christine Lagarde initially stated that it is not the ECB’s job to close spreads, suddenly the spreads in some countries like Italy and Greece, spiked up. The ECB then put out a programme, the Pandemic Emergency Purchase Programme, which in in its boldness, was impressive, and sent the message that the ECB has fully understood that in a crisis, the last thing you need is spiking sovereign yields, which make such a crisis even harder to address.

This has been a useful lesson for the institutional architecture of Europe. Even if legally, the ECB is not the lender of last resort to governments, effectively it has assumed that role. The pandemic has provided us with two important innovations or tests essential for the future stability of the eurozone.

The Green deal as a unifying theme

The Green Deal, which is the EU strategy to combat climate change, is a unifying theme in Europe, one that calls for fiscal creativity. There is a wide consensus that, in this context, an ambitious investment program has to be undertaken. Based on analysis from reputable institutions such as the International Energy Agency, the European Investment Bank, the European Commission and others, the conclusion is that roughly two percentage points of GDP of additional investments will be needed for the green transition, annually until 2050. The share of the public sector is estimated at around one third of the total.

Germany has put such an ambitious investment package in the coalition agreement. This has been a top priority of the Green party. This is also the amount needed for the rest of Europe. But in countries with relatively high debt level, the financing of such an investment package will not be easy. This is where the new German Government needs to show flexibility. When all countries invest in the fight against climate change, the benefits are greater for all including Germany.

Geopolitics and foreign policy

On geopolitics, the double shock of Brexit, and the election of Donald Trump as President in the US, has led to a reassessment of Germany’s position in Europe and the world, and of the position of Europe in the world. Germany will remain a consensus seeking country, looking for compromises which as many countries as possible, ideally all, will accept. The exit of Britain from the European Union has reinforced this policy approach.

The approach is similar when it comes to regional antagonisms. Germany for instance is interested in keeping a functioning relationship with Russia. On China, where German industry has invested heavily, the debate has changed. German industry now sees China as a strategic rival and a potential threat. The investment agreement between China and the EU, that Merkel pushed through, signals that Europe wants an independent stance on China, separate from the US. But there is more realism now in Germany about China’s intentions and methods than say five years ago.

Angela Merkel has governed through a decade of successive crises. It is unlikely the Olaf Scholz, as new Chancellor, will face a less challenging environment. There are tough issues like climate change and the new geopolitical situation, that need to be addressed and where Europe needs to be pushed ahead. At the same time the pressure to find compromises on European matters will be even stronger than before.

German foreign policy has been traditionally commercially driven. In a way Germany was outsourcing dealing with geopolitical issues and the macroeconomic management of the world economy, basically, to the US. There is currently some rethink.

On the relationship between Europe and Turkey, this was seen as a migration relationship. Because of a big Turkish community in Germany, whenever the issue of the Turkish EU membership, would come up, there would be a very strong pushback from the anti-migration movement. But there was never a geopolitical connotation to that. The argument was basically more simplified. Turkey joining the EU would mean another low-income country that would require transfers, and more migrants from Turkey when already the Turkish community in Germany is large. So, this is why Angela Merkel had to basically call off Turkey’s EU membership in 2010.

But now comes the geopolitical significance of Turkey into the equation. Turkey is a key transit country for migration and refugees. This adds a new dimension to this debate. There is also an acknowledgment that Turkey is drifting toward more authoritarianism. But Germany as already said, is a status quo country, and the status quo for migration flows is working relatively well. So, the bias in Germany will be to avoid confrontation and try to manage any conflict with Turkey.

On Brexit, Berlin wants a constructive working relationship with the UK. As a geopolitical partner in the world, the UK is incredibly important. But there is a clear sense in Berlin, at least at this stage, that Britain is not willing to find the necessary compromise to the open issues.

Germany and Europe

German attitude toward Europe has changed in important ways. Germany sees internal division in Europe and economic weakening, as a geopolitical risk. There is thus an increased emphasis on Europe’s economic strength and unity, from the German perspective. The “Recovery and Resilience Fund” is a clear evidence of this shift in attitude.

The establishment of the Recovery Fund meant that many long-standing German red lines have been crossed. It makes transfers to countries, which are sizable in some cases like Italy’s, and effectively leads to the creation of European collective debt. But from the German internal discourse there was a broad consensus in favour of the Recovery Fund. This shift is informed by the changing fiscal debate, as discussed above, and the changing geopolitical perceptions, namely that an economically strong and united Europe is needed to be able to push for its ideas and values in the world.

On further EU deepening, there might be less enthusiasm in Germany. Germans in their extreme majority, when asked, would formally express support for further EU deepening. However, when it comes to actual implementation, Germany will not be pushing in that direction. This is not because Germany is hostile to further integration. On the contrary, European integration and the EU generally as a political project is too important to Germany’s core national interest. But Germany as a consensus seeker and will not antagonise countries that would oppose more political integration.

It has been argued that Germany might want to push for more integration if in exchange there will be more majority voting in certain areas, including foreign policy. But this is not where Germany would want to put its political weight. Because qualified majority voting on foreign policy, for instance, is a particular issue for smaller countries, whose interest Germany has to take more into account after Brexit.

Click here to change your cookie preferences