By Maria Demertzis

In the 2020 revision of monetary policy strategy, the US Federal Reserve adjusted the pursuit of an inflation rate at 2 per cent, to inflation that ‘averages 2 per cent over time’.

Many worry that using average inflation over time in order to decide on policy for the future is problematic.

The first and obvious issue is the length of the period across which policymakers average out inflation.

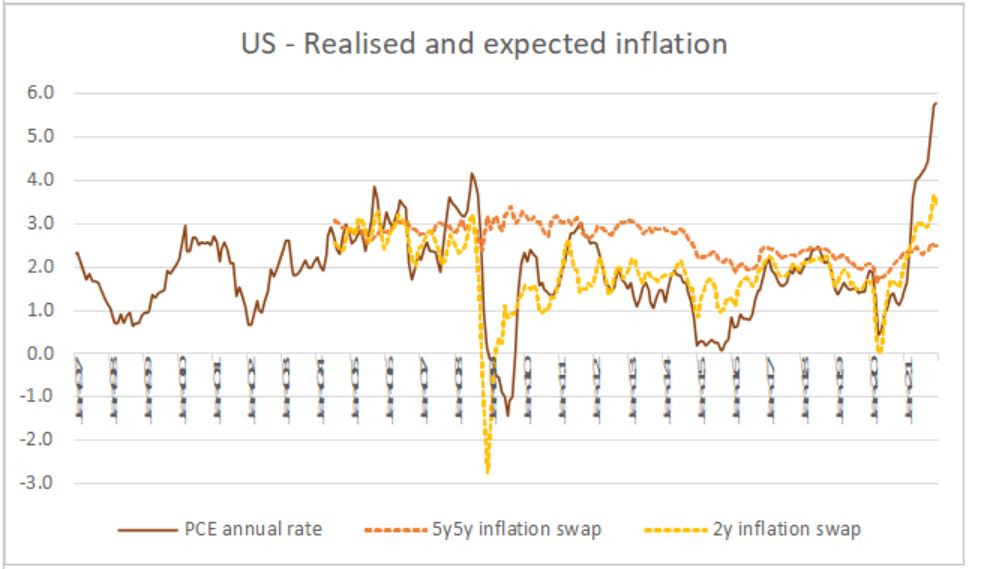

Source: Fed StLouis. Notes: PCE annual rate is the monthly inflation rate (annualised). 2y inflation swap is inflation expectations at the 2-year horizon and 5y5y is inflation expectations at the 10-year horizon. Both are market-based expectations derived from inflation swaps.

The average US inflation rate of the past 25 years is 1.8 per cent. The two straight lines across the graph above show a different average for the two halves of the past quarter century: across the first half inflation is closer to 2 per cent and in the second, it is closer to 1.5 per cent. Inflation averaged 1.2 per cent in 2020 but 3.9 per cent in 2021. Where is the sense in looking at averages, without being clear over which period this average is considered?

Second, the Fed’s explanation of the rationale for this change in inflation strategy can be interpreted as worrying a lot more about having inflation below the target rather than above it.

“… if inflation runs below 2 per cent following economic downturns but never moves above 2 per cent even when the economy is strong, then, over time, inflation will average less than 2 per cent. … To prevent this outcome …we will seek to achieve inflation that averages 2 per cent over time. Therefore, following periods when inflation has been running below 2 per cent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 per cent for some time.”

It also explains that “… if excessive inflationary pressures were to build or inflation expectations were to ratchet above levels consistent with our goal, we would not hesitate to act.”

There are good reasons to worry about very low and long-lasting inflation but as the current inflation rates demonstrate the discomfort that can come with very high inflation does not deserve less concern. Can the Fed really sustain this asymmetry?

The last problem has to do with the interplay between inflation and inflation expectations. Anchored expectations at the inflation target help central banks achieve price stability. And the opposite is true. Expectations that are not anchored at the target compromise the ability of central banks to achieve inflation at the target level.

But what determines whether expectations are anchored? Central bank credibility is the answer, but then only one of two things can be true.

Either the central bank is credible, in which case agents believe that it will achieve its objective. For example, workers that have to negotiate wages believe that the Fed will achieve inflation equal to 2 per cent irrespective of what inflation they observe, and that is what their wage demands will reflect.

Or, the central bank is not credible, in which case expectations are all about what agents see. The wages they negotiate will reflect the inflation workers experience and the higher the current inflation rate, the more relevant the present becomes.

Consider the current juncture in the US. Inflation in 2021 was 3.9 per cent, but the numbers in early 2022 are in excess of 5 per cent. If workers do not have faith that the Fed can bring inflation down to 2 per cent, then workers are more likely to demand compensation closer to 5 per cent rather than 2 per cent to protect the purchasing power of their wages.

Irrespective of credibility, averaging inflation over the past is not useful. It is quite extraordinary that the Fed opted to modernise its monetary policy framework and introduced such a level of opacity, when all literature suggests that transparency and clarity, in particular in the policy decision process, is necessary to achieve credibility.

Having an explicit inflation target that is clear and easy to understand helps clarify the intentions of the central bank. But holding the central bank to account, which is necessary for building and sustaining credibility, requires communicating which levels of inflation are tolerated and which are not.

Therefore, a strategy that communicates both a target but also tolerance bands around it, is very clear in defining when central bank policy is successful and when it is not. This is then equivalent to saying that it will aim to keep inflation on average at 2 per cent, but really between, say 1 and 3 per cent, which is what the Bank of England does.

Introducing average over time without defining what this means is counterproductive and the current levels of inflation in the US will sooner or later expose this weakness in the Fed’s new strategy.

Maria Demertzis is the Deputy Director at Bruegel, a Brussels based think-tank. This piece was originally published as an opinion column on the Bruegel blog and as a post in the Cyprus Economic Society blog.

Click here to change your cookie preferences