With clarity expected in September, rumours about the viability of the EuroAsia Interconnector were somewhat inaccurate

The EuroAsia Interconnector, what would be the world’s longest subsea energy cable, remains on track, its backer said on Sunday, branding reports the project faces financing woes to the extent that the plug might have to be pulled as out of proportion.

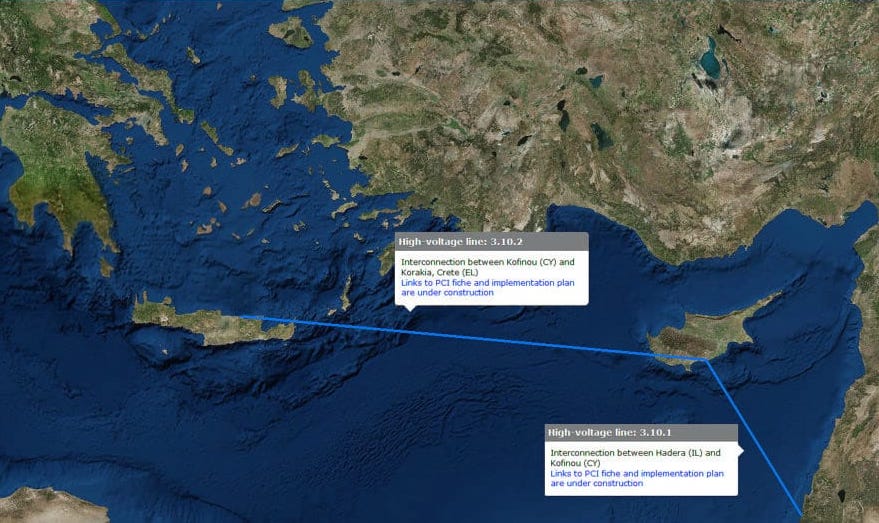

EuroAsia is a submarine power cable stretching 310km from Israel to Cyprus and another 898km from Cyprus to Greece, running across the Mediterranean sea floor at depths of 3,000 metres. Dubbed a ‘strategic project’, it would end Cyprus’ energy isolation, linking it with the European electricity grid. The EU has designated it a Project of Common Interest (PCI), authorising €657 million in funding, with another €100m coming from the Cyprus Recovery and Resilience Fund (RRF).

But last month it emerged that the bill for the project had blown up by 23 per cent because of the rising costs of raw materials and manufacturing. The initial cost estimate of €1.57 billion jumped up to €1.97 billion, with EuroAsia reportedly seeking an amount in the region of €600m in loan guarantees from the Cypriot state.

This raised a series of questions, as what was meant to be a privately-funded project could now burden the Republic with almost a third of its funding requirements. If the company couldn’t find private investors for the project, didn’t this raise questions about its viability? Why had private investors shown no interest?

EuroAsia had also applied to the European Investment Bank (EIB) for a loan, but the latter had yet to respond.

A week ago Kathimerini ran a story citing an anonymous ‘representative’ of the EIB, who said the bank had commissioned a feasibility study, the findings of which were not enthusiastic. Kathimerini presented this as a ‘No’ from the bank.

But EuroAsia said the EIB study – done by an external consultant – had not in fact given the thumbs-down. Rather, EuroAsia said, the study found that the project was viable, but that it would be better for Cyprus to invest in battery storage for renewables.

The company stressed the EIB has not formally rejected the loan application, and that the application was still being reviewed. In addition, “the Project Promoter [EuroAsia] is in parallel consultation with a leading European government organisation and, together with international financing institutions, is proceeding with the conclusion of a syndicated loan.”

The Sunday Mail has learned that the “leading European government organization” is a Norwegian state fund.

Meanwhile, Energy Minister George Papanastasiou said the government was now looking at three options. He justified a possible bailing out of the project by the government on the grounds that it was a strategic project and that it was difficult for a private company to fund a €1.97 bn enterprise.

The first option would have the government not getting involved and leaving the project promoter to find the funds. The second would be for the government to provide a loan guarantee, and the third would be for the state to take a shareholding in the company, which would also give it a say in the project.

All this public back-and-forth has only served to fuel the sense that the endeavour was facing stormy seas.

Industry sources confirmed EuroAsia did file a €580 million loan request to the EIB but this dates back several months – during the previous administration of Nicos Anastasiades.

That request came at a time when the project was costed at approximately €1.5bn. With the EU ‘giving’ €657 million and promising another €100 million from the Recovery and Resilience Fund (RRF), that left approximately €740 million as the financing shortfall.

The sources also verified that the EIB has not formally replied yet – that the matter is still in an “exploratory phase.”

So as it now stands, the financing shortfall comes to a little over €1 billion. The updated figures included the €300 million to €400 million (depending on whom you ask) extra which Nexans – the company contracted to manufacture the cable – has asked for.

The agreement to build the cable got locked in this July. The price tag – about €1.4 billion. The rest of the cost mainly covers the transformer stations on Crete and Cyprus, with Siemens picked as the contractor.

The same sources also said that Greece’s Admie (Independent Power Transmission Operator) will likely enter the project with a 25 per cent stake – “probably €200 million.” This would be in direct equity, that is, Admie would ‘buy into’ the project.

Admie is 51 per cent owned by the Greek state. It is currently having a due diligence study done to help it decide definitively whether to jump in.

Other sources said Cyprus could likewise buy into the project via the EAC – not as the Republic of Cyprus per se.

As for the remaining financing, it would come “from private investors and institutional investors – for example the EIB or similar.”

They also pointed to the recent joint statement by the respective energy regulators in Cyprus and Greece green-lighting the project.

“So now that the permits are OK, this is when you go looking for financing.”

We’re told that Nexans would need at least 36 months to manufacture the cable, and another year to lay it. This concerns the segment from Cyprus to Crete.

The sources stressed why it was important to get a line of credit from institutional lenders like the EIB – for the low interest rate. By contrast, commercial lenders would charge higher rates.

And far from the project skidding off the rails, they said that EuroAsia and the EIB have scheduled a meeting for September to discuss the very EIB-commissioned study which has apparently thrown a monkey wrench in the works.

Also in September, an advance payment will have to be made to Nexans so that they get to work.

“So everything converges on September… a crucial timeframe,” commented the sources.

Nevertheless, the industry sources stressed that the issue of the Cypriot state becoming a shareholder in the project “has never been on the table.”

Asked to confirm if so far no private funding has been secured, the sources said yes. But they insisted this was no “deal breaker.”

For his part, the energy minister reiterated the geostrategic importance of the proposed interconnector.

“As far as the Republic of Cyprus goes, the project has political support, as it does from the EU,” Papanastasiou said.

“For Cyprus, the project is important for four reasons: security of electrical energy and therefore of electricity supply; it ends the island’s electricity isolation; it boosts the penetration of renewables in the energy mix; and it creates prospects for an energy hub in Cyprus connecting Middle Eastern countries with Europe for channeling electricity there.”

The minister added that Cyprus is “assessing the project from both geostrategic and economic standpoints, and will decide within the next three months whether to get involved or not. Any decision will be taken in conjunction with Greece.”

Our other sources confirmed this, saying the Cyprus government has commissioned a consultant to assess the viability of the state becoming involved with a report due by November.

On the funding shortfall, they likewise spoke of a syndicated loan – where a group of banks get together to finance a project, each taking a part of the risk.

“For reasons that should be obvious, it’s easier for a state-backed or state-funded company to ask for financing,” they noted.

Energy expert Charles Ellinas likewise suggested that the situation has been misrepresented.

“From what I hear, the EIB study/evaluation found the project viable and that it would bring a net annual benefit of €300 million to Cyprus, from the expected decline in electricity prices. Electricity prices could drop by as much as 20 per cent.

“But they had that counterfactual scenario – battery storage versus the interconnector. But this has nothing to do with the interconnector.”

Ellinas explained that the EIB has yet to study the report internally and come to a decision. The lender will also be speaking with the loan applicant.

“There are many steps left, the study by the EIB’s external consultant is non-binding anyway, so this is by no means the end of the line as some have portrayed it.”

The analyst recalled that European governments – including Cyprus – are shareholders in the EIB.

“This was the view of one individual (who spoke to Kathimerini) inside the EIB, not of the EIB board.”

He explained that the cost of the interconnector would be recovered from users of the cable – companies either importing or exporting electricity through the cable.

“Financing is the last step – because investors/banks need to know the particulars such as who the contractor is. Yes it’s also the most difficult part of a project – convincing banks to part with their money. But this is how it works, nothing unusual going on here.”

Ellinas also recalled that the European Commission had commissioned a feasibility study, which gave the project the nod.

“Keep in mind that no more than 10 to 20 per cent of projects proposed to Brussels proceed to the stage of the feasibility study. That should tell you Brussels thinks the project is feasible.”

No money from the EU has yet to be paid out. This will happen once certain milestones are met – such as the construction schedule.

“It’s a project of such complexity and magnitude – so of course you have to jump through many hoops.”

The analyst pointed out that EuroAsia has a lot going for it: “They’ve put together a top-class team – Nexans, Siemens, Clifford Chance and Price Waterhouse Cooper.”

Click here to change your cookie preferences