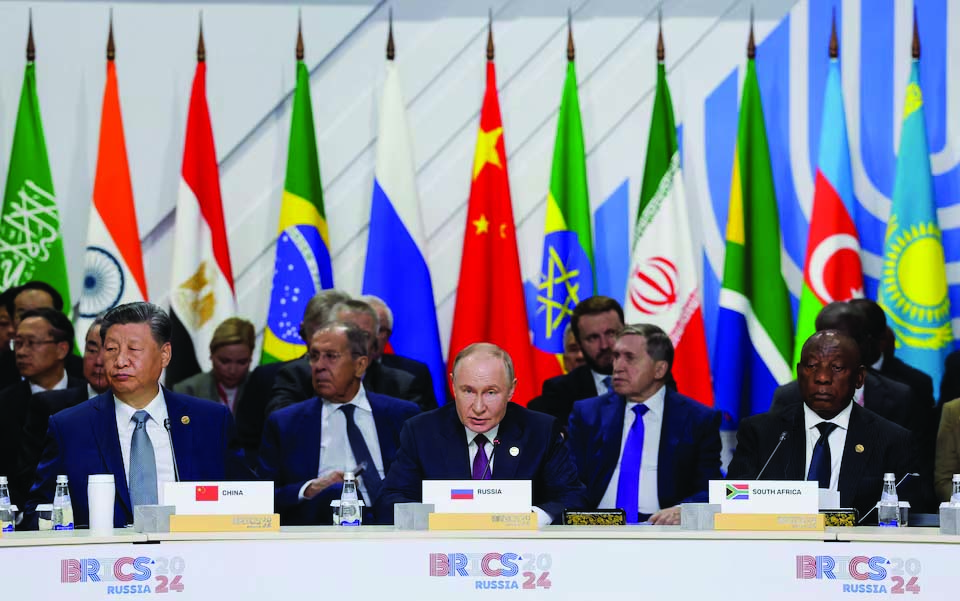

Indonesia’s recent accession to the Brics coalition highlights the ongoing and ambitious efforts of its member countries to create a rival to the G7, the alliance of the world’s most powerful Western economies.

Brics currently has 11 members (Brazil, Russia, India, China, South Africa, Egypt, Iran, UAE, Saudi Arabia, Ethiopia and Indonesia), whose share of the global economy amounts to about 40 per cent.

Although, on the surface, Brics appears undeterred by the outcome of the US presidential election, the assertive stance of Donald Trump is expected to have significant implications. During his first term, Trump imposed high tariffs, particularly on Chinese products, leading to an intensification of global trade tensions.

If he carries out his threats to impose tariffs of up to 100 per cent on Brics countries, on account of their efforts to reduce their dependency on the US dollar, the result will be a resurgence of tensions, causing worldwide instability and, at the same time, testing the cohesion of Brics.

Admittedly, as the responses of Canada, Mexico and China have indicated following the recent announcements by President Trump to impose tariffs on these three countries, the possibility of widespread implementation of high tariffs by the new US administration is surrounded with uncertainty.

This is because of the counter-threats for compensatory measures by the affected countries, some of which are key trading partners of the US, and also the resulting inflation for the US itself.

The tough stance adopted by the Trump administration, taking into account that the dollar’s share exceeds 70 per cent of global trade transactions, is expected to lead to either: (a) a push by the Brics countries to strengthen their economic ties with each other and their efforts to shift away from the dollar, through the possible development of alternative financial systems, such as Brics Pay, or (b) the weakening of Brics, due to centrifugal tendencies from countries that believe they would benefit more by adopting a US-friendly policy.

In practice, although China and Russia trade with each other in yuan and ruble, the creation of a common Brics currency remains an extremely difficult task. The degree of economic convergences and complex structures required for the success of such a grandiose undertaking have not been achieved, reflecting the different economic characteristics and interests of the Brics countries.

Within this context, the geopolitical landscape is also undergoing changes. Trump’s threats to impose stricter sanctions and tariffs on Russia, if the war in Ukraine is not concluded soon, could, on the one hand, worsen US-Russia relations, bringing the latter closer to its Brics partners. On the other hand, a quick end to the war could provide new momentum for Russian-US and EU trade cooperation.

In any case, the West-East rift seems to be deepening, at a time when Trump’s unpredictable economic and foreign policy is leading to increased uncertainty.

In summary, the possibility of economic disruption may strengthen the Brics’ resolve for greater economic cooperation among them and independence from the dollar.

Ultimately, the future success of Brics will depend on its members’ ability to seize the opportunities presented by a changing world order. This would in turn depend on the Brics members’ ability to collectively address the challenges, which, at the moment, does not appear as a likely scenario.

Andreas Charalambous and Omiros Pissarides are economists and the opinions they express are personal

Click here to change your cookie preferences