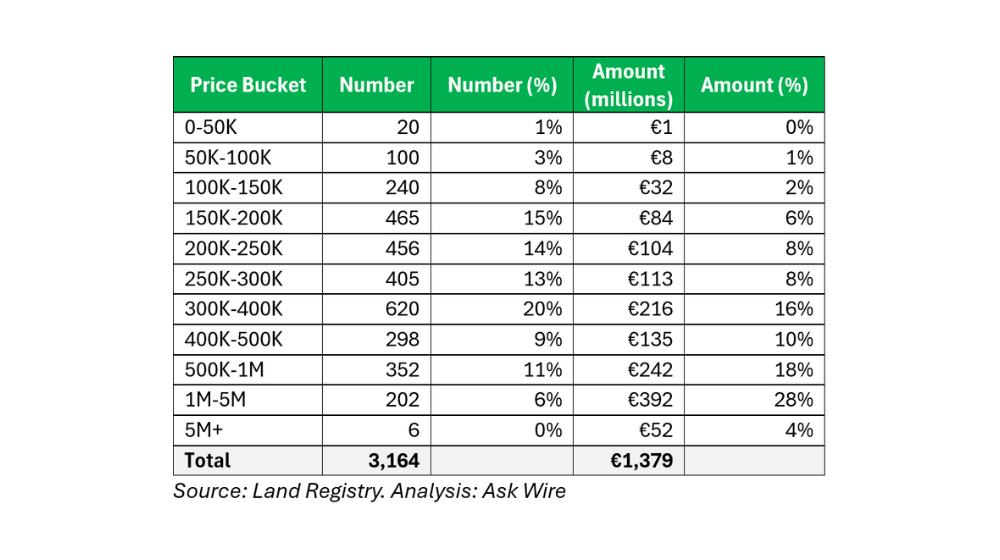

Limassol’s urban residential market remains the heartbeat of Cyprus’ property sector. The latest Land Registry data, processed by Ask Wire, reveals 3,164 residential transactions took place in 2024, amounting to €1.38 billion. These figures provide a crucial pulse-check on where demand is surging, which price brackets dominate, and where opportunities lie. Whether you’re an investor, developer, or agent, understanding the market’s data-driven trends will help you make smarter, more informed decisions.

Luxury market: where high-value transactions are concentrated

The €1M+ luxury segment accounted for 32 per cent of total transaction value (€441M), but only 8 per cent of sales (253 transactions)—a clear indicator that Limassol’s coastal zones remain a magnet for high-end buyers.

- Lemesos Municipality recorded 45 transactions in the €1M-€5M range, totalling €86M, underlining its dominance in the high-end market.

- Germasogeia led in sheer volume, with 81 luxury sales surpassing €150M, solidifying its status as Limassol’s prime residential hotspot.

- Agios Tychonas saw 30 transactions between €1M-€5M (€60.7M total), plus two €5M+ deals (€11.2M total), proving continued appetite for premium residences.

- Mouttagiaka recorded 20 transactions in the €1M-€5M range (€43.2M) and two €5M+ deals totalling €25.2M, reflecting strong investor confidence in its high-end developments.

Mid-tier market: the engine of transaction activity

While luxury homes drive value, the €200K-€500K price range dominates transaction volume, accounting for 43 per cent of all sales (1,362 transactions) and 39 per cent of total market value (€537M).

- Mesa Geitonia saw 134 sales in this range, totalling €49M, making it a prime location for mid-range buyers.

- Ypsonas and Kato Polemidia collectively recorded over 300 sales in this bracket, worth €114M, indicating growing demand for well-priced homes just outside Limassol’s core.

Affordable housing: a niche with growth potential

Properties below €200K represented 25 per cent of all transactions (791 sales), but only 12 per cent of total value (€165M), reflecting a constrained supply of entry-level homes.

- Ypsonas and Kato Polemidia accounted for 210 of these transactions, reinforcing their position as Limassol’s emerging affordability hubs.

What this means for investors, developers & agents

Limassol’s real-estate market remains diverse, balancing high-value luxury transactions with a robust mid-tier housing sector and limited affordable housing supply. Developers should take note of growing demand in suburban areas, while investors may find opportunities in both prime and emerging locations.

With over €1.38 billion in transactions, one thing is clear: data is the key to navigating Limassol’s evolving property landscape. Ask Wire’s analytics empower industry professionals with real-time market intelligence, helping them make informed, strategic decisions in Cyprus’ most dynamic real-estate market.

Transaction volume and value: Residential properties in urban Limassol (2024)

Know where demand is growing—before everyone else does. Contact [email protected] to unlock location-specific insights for your next project.

Click here to change your cookie preferences