The imposition of tariffs by the United States strengthens deglobalisation and may lead to short-term increases in the prices of certain goods while uncertainty remains, according to economist Tassos Yiasemides.

Speaking to the Cyprus News Agency (CNA), Yiasemides also said that he considers the European Union–United States agreement to be unbalanced for the EU.

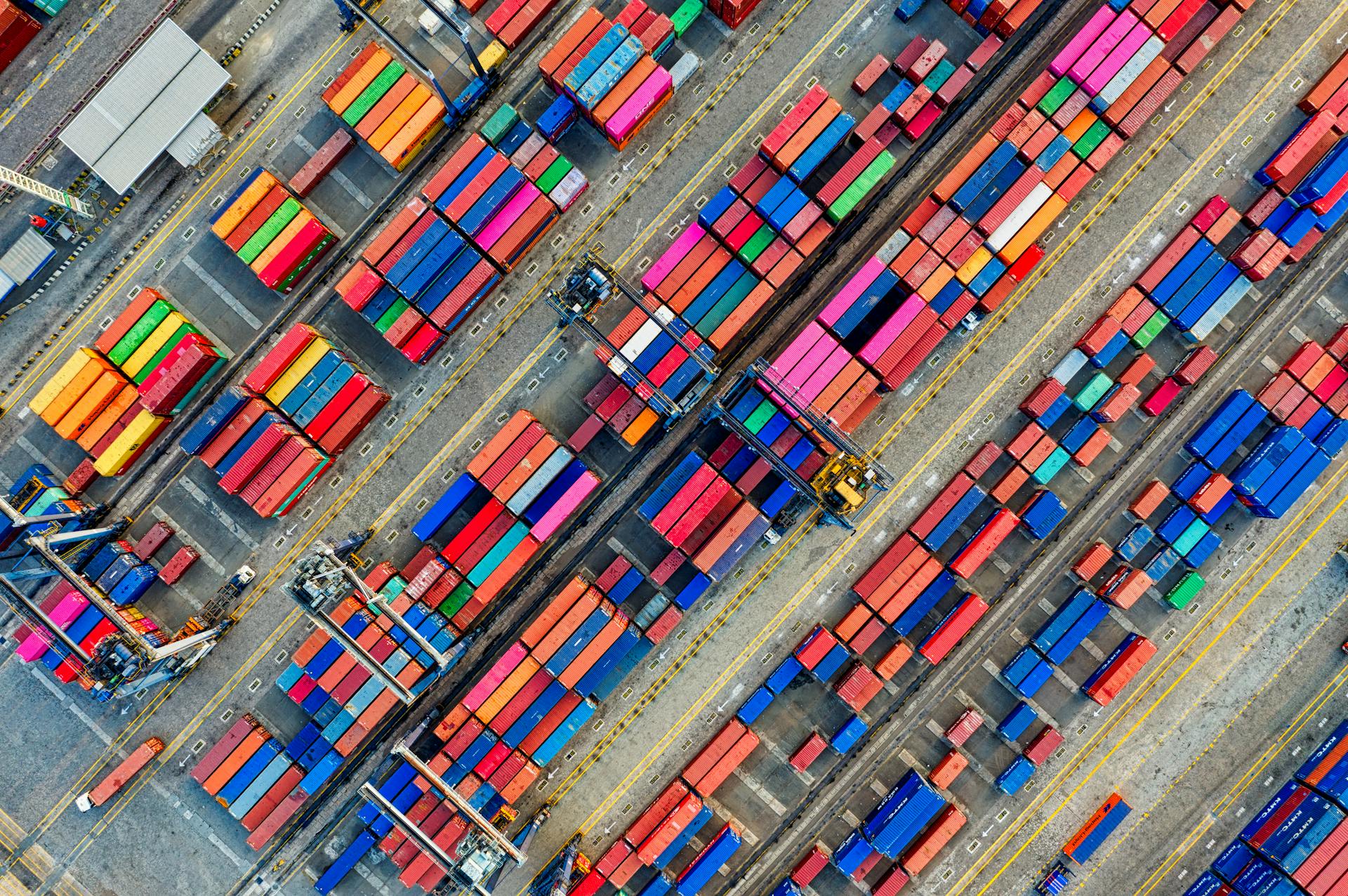

At the same time, he said that the new tariffs announced by Donald Trump are causing problems in the supply chain.

He added that the fact that the euro has strengthened against the dollar is also weighing on the EU, making European products more expensive, with tariffs combined with a 10 to 15 per cent increase due to the exchange rate.

Yiasemides said that “uncertainty remains because many agreements have not been finalised while the new announcement by US President Donald Trump regarding the imposition of tariffs on a large number of countries is causing reactions and problems in the supply chain”.

“In the latest decree,” he continued, “there is specific reference to monitoring the situation so it is clear that there will be changes while the Article 232 tariffs with their exemptions are still pending, he said, adding that this remains an outstanding issue even for the preliminary agreement with the EU”.

On the agreement between the United States and the EU regarding the imposition of tariffs, Yiasemides said that “the current trade agreement appears to deviate from the philosophy of the EU, which has traditionally invested in promoting free trade and multilateral cooperation based on common rules and institutional dialogue”.

“Although it temporarily reduces insecurity and volatility it has also been described as a dignified defeat because”, he said, “while the 30 per cent tariff level was avoided, the agreement is considered unbalanced”.

Furthermore, he stated that “the EU-United States agreement emerged from a quick and rather unilateral dialogue without substantial consultation with member states, without serious public debate and without a clear assurance of symmetrical concessions”.

“The fact that it was signed without the full institutional depth of the EU, in a semi-official environment, created impressions of inadequate preparation or even a hasty acceptance of external terms,” he added.

He further stated, however, that “clarifications are needed regarding its practical application, such as the specific products subject to the specified tariff rate, and added that tariffs on pharmaceutical products have been deferred until 2027 while the 50 per cent tariff on steel and aluminium remains”.

“The fact that the euro has strengthened against the dollar despite interest rate cuts by the European Central Bank makes European products more expensive, with tariffs combined with a 10 to 15 per cent increase due to the exchange rate”, he underlined.

“At the same time, the ECB is called upon to balance the strengthening of the euro’s exchange rate, economic growth challenges in the euro area and potential new inflationary pressures”, he continued.

Referring more specifically to the EU-United States agreement, Yiasemides said that there are significant commitments regarding the purchase of fossil fuels, noting that the amount that must be spent within three years is considered excessive.

In this context, he pointed out that some reports suggest that “Europe will become energy dependent on the US after Russia as well as on the purchase of armaments programmes”.

“This contradicts the EU’s own decisions on green transition, digital innovation and strengthening European strategic autonomy,” he stressed.

He explained that the 15 per cent tariff “will only affect European products imported into the United States and not the other way round while Europe remains a net and significant importer, possibly even dependent, on US technology”.

According to Yiasemides, “the EU does not appear to have put on the table issues relating to the taxation of technology companies operating in Europe”.

“The only concern seems to have been reducing tariffs on cars to safeguard the interests of certain countries or at least avoid irreparable damage,” he said.

What is more, he said that “the economic impact of the agreement is expected to become more apparent over time”.

Citing some initial estimates, Yiasemides said that the new trade regime could lead to a slowdown in Europe’s industrial sector and in countries with a strong export presence.

At the same time, he said that “the reduction in outward-looking activity combined with existing fiscal pressures may limit the fiscal flexibility of states already facing challenges”.

Moreover, Yiasemides said that “Europe needs new policy tools and institutional renewal in order to be able to negotiate as an equal partner in an increasingly competitive environment”.

He added that “the return to the logic of protecting industrial capacity does not mean a departure from the principles of free trade but an adaptation to the new reality”.

“Europe cannot remain open when its main partners are choosing increasingly inward-looking strategies”, he concluded.

Click here to change your cookie preferences