Long gone are the times when space used to be a matter of scientific observations and defense strategies restricted to only a few. In the past decade, the industry, dating back to more than 60 years ago, has made a quantum leap as vast expanses of the cosmos welcomed fleets of diverse spacecraft to not only expand our understanding of the universe beyond the Blue Marble but also deepen our knowledge about Earth. Today, humanity utilizes satellites to connect previously off-the-grid areas with the rest of the world and glean unprecedented insights into natural phenomena and human activities.

Space technologies are no longer out of our grasp: they are revolutionizing major economic sectors and business operations, finding their way into numerous aspects of our lives, from how we navigate in the modern world to how countries protect borders from intrusion to how farmers irrigate crops. Thanks to the rapid development of computing, data analysis, and AI, satellite data analytics have become so ubiquitous that getting satellite images of the Earth to meet your needs is now a matter of minutes. It’s only natural that demand for satellite solutions and services keeps rising and drives sustained growth of the space technology market, so let’s delve into its current landscape, major segments, challenges, and promising new tech advancements.

Market overview and growth trends

Like the cosmos itself, the global space tech market is vast, encompassing a wide array of technologies, services, and solutions designed to explore and utilize space. Its key segments include space vehicle manufacturing, launch services, satellite navigation, broadcasting and telecommunications, weather forecasting, and Earth observation. Space tourism and space mining are emerging technologies propelled by the latest innovations that have yet to mature.

With an estimated total market value of $443.2 billion in 2023, the global space technologies sector is expected to more than double in the coming decade. Experts anticipate a CAGR of 7.54%, which will boost the market to $916.85 billion by 2033.

North America controls the largest slice of this pie, controlling over 55% and followed by Europe with a 22% share. The region is well-placed to maintain its leadership for years due to robust investments, technical innovations, and a favorable regulatory environment. North America is a strong rival with NASA and the Canadian Space Agency dominating the national space sector alongside a vibrant private sector led by SpaceX, Tesla, and other pioneering space companies.

On the other hand, Asia Pacific represents a dynamically developing region that is snapping at Europe’s heels with an 18% market share and a projected CAGR of 9.05% in the next decade. India, China, and Japan are among the countries that have made strides in securing their own space missions covering a spectrum of applications, from science to telecommunications. With the growing number of regional strategic collaborations, investments in technology, and a surging private sector, Asia Pacific manifests itself as an ambitious market player aspired to space exploration leadership.

The space technology market shows no sign of slowing down, and for a reason: continuous tech advancements and increasing private company participation drive competition in the sector and its growth to meet the ever-increasing demand for connectivity and data.

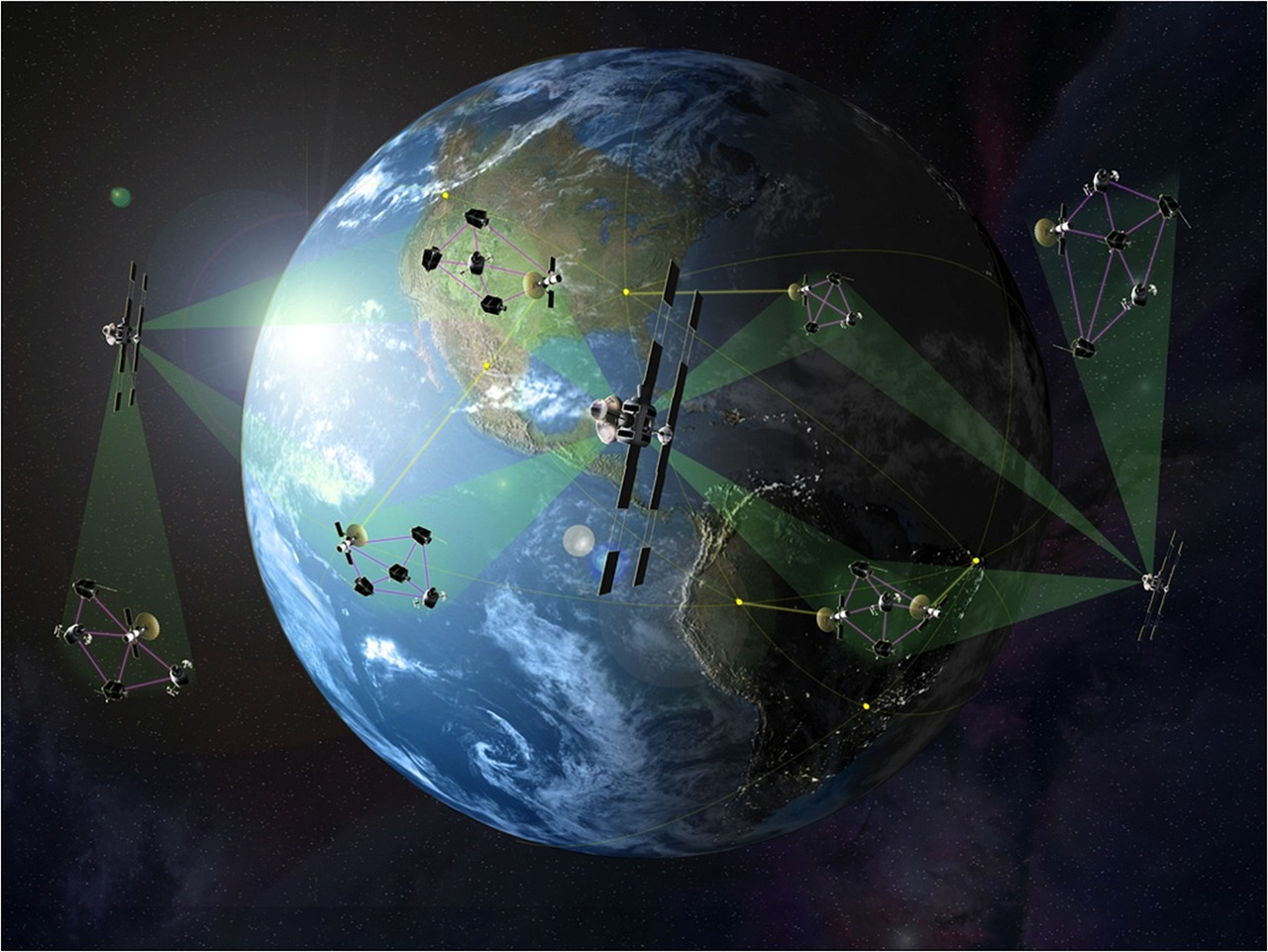

Governments respond to it by allocating more investment and partnering with space agencies and commercial market players to facilitate knowledge-sharing and foster innovations. The miniaturization of spacecraft and the availability of reusable rockets make space more accessible, attracting a broader range of companies and organizations to the market. Communication satellites gain traction as mankind aims to bridge the digital gap and bolster inclusion and connectivity through space-based Internet.

Technological advancements in satellite systems

The global space technology market expands primarily due to constant innovation and development of its hardware and software segments. The miniaturization of satellites, advancements in propulsion systems, and impressive endeavors in robotics empower new applications and value-added services, inviting more businesses to join the market.

The latest innovations in propulsion technology, including improved propellant formulations and combustion processes, high-thrust liquid propellant engines, enhanced nozzle design, and other advancements, are making space missions more efficient and environmentally friendly. Standardized satellite designs speed up mission development as engineers craft payloads to meet the interface standards and ensure proper integration, thus shortening the testing and development cycles.

The proliferation of small satellites is among the key drivers in the fastest-growing segment within the space ecosystem: Earth observation. A nanosatellite the size of a shoebox or a minisat not larger than a fridge comprises the same components as a large conventional spacecraft while being more affordable to launch and maintain. The mass production of CubeSats and other mini-satellites using low-cost manufacturing methods has enabled a broader spectrum of value-added services (VAS), such as historical and current satellite imagery analytics.

Furthermore, cutting-edge satellite sensors capable of capturing satellite views of the Earth at higher spatial and spectral resolutions have paved the way for applications beyond weather forecasting. In particular, disaster management gained traction last year as the major growth area within the VAS segment, reflecting global efforts to utilize real-time satellite views of affected areas to improve disaster response and build overall resilience in the face of intensifying weather calamities. Environmental observations are trending, too, as recent satellite images are quality enough to provide insight into greenhouse gas emissions, carbon sequestration, coral bleaching, deforestation, and other aspects related to the pressing challenge of climate change. However, amidst the rising geopolitical tensions, the defense segment still accounts for the largest market share.

Widespread digitalization increases the role that satellite imagery and derived insights play in global economies, boosting the emergence of cost-efficient digital platforms and solutions for various industries. EOSDA LandViewer is one example of a digital tool powered by cloud technology and satellite data. It facilitates users’ access to vast amounts of archived and recent satellite images, regardless of their geospatial expertise. With it, anyone can quickly search, visualize, and analyze satellite data collected from an impressive array of sources.

Application areas expanding due to satellite technologies

The demand for satellite data and related services is driven by the growing utilization of satellite views of the Earth in agriculture, telecommunications, defense, and other application areas.

More than anything else, satellite data enables precision agriculture practices by measuring plant’s individual needs for water, nutrients, or crop protection agents. Thus, farmers can adjust the rates and timing of input applications throughout the season to ensure proper crop development, secure high yields, and cut production costs. Growers worldwide turn to up-to-date satellite images to detect pests, diseases, and other sources of stress in plants ahead of the tangible damage. Moreover, satellite data combined with machine learning algorithms enable accurate crop classification, yield prediction, and other critical services to inform decision-making across the food supply chain and improve food security.

The telecommunication sector also benefits from satellites that ensure high-speed Internet and mobile connectivity in areas where traditional land-based infrastructure fails to provide adequate support. Today, geostationary and Low Earth orbit satellites prove indispensable in global telecommunications, enabling real-time data transmission, TV and radio broadcasting, and connecting people to the Internet in offshore locations or lands with complex terrain.

Defense takes the best of both worlds, utilizing various types of satellites. Communication satellites connect the geographically dispersed army forces in real time, while reconnaissance spacecraft supplies intelligence data about the enemy during war conflicts. Navigation satellites, in turn, ensure precise navigation and positioning for operations on and off the shore.

Challenges facing the satellite technology sector

Technology progress goes hand in hand with bottlenecks and hurdles impeding further growth. With satellite technologies, these include technological barriers, such as a lack of core component suppliers and uniform standards resulting in higher costs, alongside regulatory gaps and environmental concerns, e.g., the growing amount of space debris.

While technologies race forward, space regulations lag behind. Given the commercialization and militarization of space, enforcement of adequate national and global regulations is urgent. To prevent the buildup of tension, degradation, and abuse of the cosmos’ expanse and ensure equal participation by all parties, the space-leading nations must elaborate clear guidelines as to what is allowed in space.

In all likelihood, emerging innovations and advances in space technologies will continue propelling the global market to new heights, with the U.S. and Canada leading the race. Miniaturization, commercialization, and digitalization are expected to be the key growth drivers, expanding the applications of satellite technologies and space-based services across a range of industries. Satellite views of the Earth belonging to the EO segment with the highest growth rate will enhance global efforts to mitigate climate change and strengthen food security. Despite many multi-faceted challenges, proper international space regulations are seen as a potential solution for equal, sustainable, and peaceful utilization and exploration of space in the years to come.

Author

Rim Elijah holds a double degree in business administration and political science from Stockholm University. As a VP of Sales, she oversees all aspects of business model development and implementation and the growth of the company’s global coverage. She has successfully established a number of strategic partnerships with an emphasis on sustainable solutions in Australia, Africa, and Asia.

Click here to change your cookie preferences