reum has completed its Wyckoff re-accumulation phase, entering expansion territory amid BlackRock’s $110 million ETF purchase. Analysts have projected a rally toward $8,400 as Phase E unfolds, following months of sideways action and seller exhaustion. Yet, this measured ascent pales against the surge potential in emerging altcoins, particularly DeFi cryptos like Mutuum Finance (MUTM).

Investors have sought the best crypto to buy now, drawn to Ethereum’s institutional backing while eyeing new cryptos for sharper gains. BlackRock’s inflows have tightened supply through exchange outflows, yet MUTM’s presale has raised $17,950,000 with 17,450 holders since inception.

Phase 6, priced at $0.035, a 250% rise from Phase 1’s $0.01, stands 75% filled across 11 phases. This setup has positioned MUTM as a top crypto to buy, outpacing Ethereum’s deliberate recovery with promises of 400% returns post-launch at $0.06.

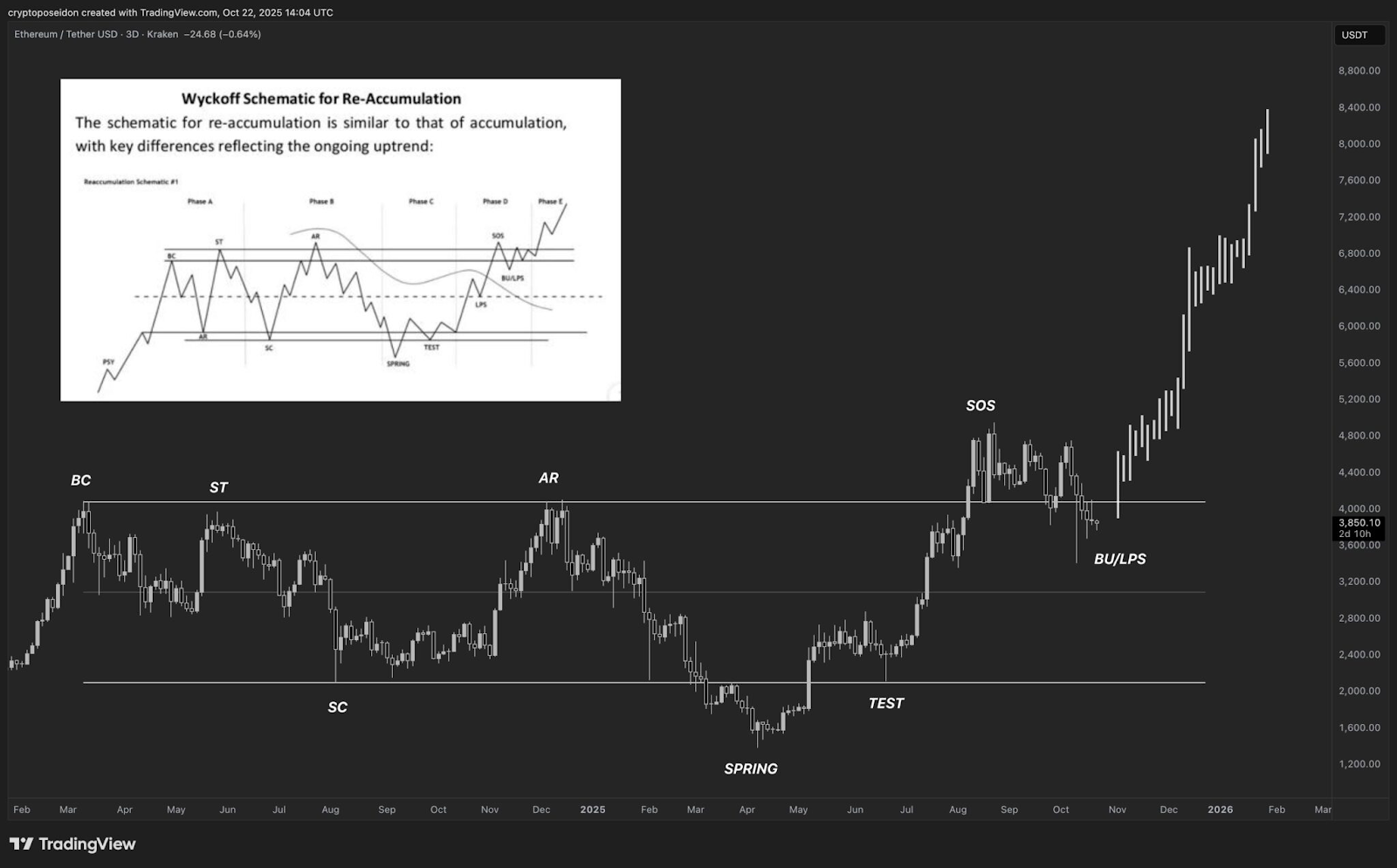

Ethereum’s Wyckoff pattern builds momentum

Analysts have tracked Ethereum’s price through a precise Wyckoff re-accumulation since early 2024. Phase A had unfolded from March to late June that year, establishing preliminary support and a selling climax. Then, Phase B extended sideways into March 2025, absorbing supply via secondary tests.

Phase C, from March to late July 2025, had confirmed exhaustion with Spring and Test formations. Subsequently, Phase D marked a sign of strength, backed by a last point of support. Now, Ethereum has entered Phase E, trading at $3,870 with a 0.87% daily gain. This structure has reinforced bullish conviction, especially as outflows hit $5 million on October 23.

Holders have preferred staking over selling, enhancing scarcity. Vitalik Buterin’s proof system upgrade has further bolstered forecasts to $10,000. Yet, such gains unfold gradually, lacking the velocity of fresh DeFi entries. Therefore, Ethereum’s path has offered stability, but savvy buyers have scanned for altcoins with amplified upside.

Mutuum Finance presale hits phase 6 milestone

Mutuum Finance (MUTM) has accelerated its presale, capturing attention as the best crypto to buy now amid market corrections. Phase 6 has sold 75% of tokens at $0.035, urging participants to act before depletion. Investors have scooped positions swiftly, knowing Phase 7 will hike prices 14.3% to $0.04.

This urgency has echoed in the dashboard’s 24-hour leaderboard update, where top depositors earn $500 in MUTM daily—provided they complete one transaction before the 00:00 UTC reset. Leading buys in the past day included $2,241.83, $1,944.10, and $1,023.29, fueling community drive.

Moreover, a $100,000 giveaway has distributed $10,000 in MUTM to each of 10 winners; entrants have submitted wallets, finished quests, and invested at least $50 to qualify. Such mechanics have onboarded 17,450 holders, transforming MUTM into a new crypto powerhouse. Early adopters have locked 400% post-launch yields, far eclipsing Ethereum’s tempo.

Dual lending model drives passive yields

Mutuum Finance has crafted a hybrid system for lending and borrowing, blending Peer-to-Contract pools with Peer-to-Peer markets. Users have deposited ETH or USDT into P2C pools, earning APYs up to 12% as borrowers tap liquidity at dynamic rates.

For instance, a $1,000 ETH deposit has yielded $120 annually while collateralizing loans at 75% LTV—say, borrowing $750 in USDT without liquidating holdings. P2P channels have enabled direct deals for niche tokens, negotiating terms like 8% fixed rates over six months. mtTokens have accrued interest, redeemable for principal plus gains, fostering passive income streams.

This setup has tied protocol fees to MUTM buybacks, redistributing value to stakers and amplifying token utility. As the platform has prepared for Q4 2025 testnet launch on Sepolia—with ETH and USDT as initial assets—borrowers have tested collateral management seamlessly. Lenders have reported steady returns, underscoring MUTM’s edge over Ethereum’s broader but slower ecosystem.

Security enhances investor trust

Mutuum Finance has launched its Bug Bounty Program in partnership with CertiK, allocating $50,000 USDT for rewards across four severity tiers: critical, major, minor, and low. Ethical hackers have claimed bounties up to $2,000 for critical flaws, fortifying the codebase before mainnet. This initiative has complemented a 90/100 CertiK audit score, ensuring robust smart contracts.

Meanwhile, potential tier-1 exchange listings have loomed, promising liquidity surges post-presale. Developers have integrated Chainlink oracles for precise pricing, minimizing liquidation risks through fallback feeds. Such layers have drawn institutional eyes, positioning MUTM as the best crypto to invest in for DeFi enthusiasts. Phase 6’s rapid sell-out has intensified this appeal, closing the window on $0.035 entries.

DeFi’s next altcoin surge unfolds

Ethereum’s recovery has steadied the crypto market, yet Mutuum Finance (MUTM) has ignited fiercer speculation as a DeFi crypto primed for explosion. Investors have weighed the best crypto to buy now, favoring MUTM’s yields and safeguards over ETH’s methodical climb. This contrast has highlighted altcoins’ role in rapid appreciation. Secure your stake in MUTM’s presale today.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER – “Views Expressed Disclaimer – The information provided in this content is intended for general informational purposes only and should not be considered financial, investment, legal, tax, or health advice, nor relied upon as a substitute for professional guidance tailored to your personal circumstances. The opinions expressed are solely those of the author and do not necessarily represent the views of any other individual, organization, agency, employer, or company, including NEO CYMED PUBLISHING LIMITED (operating under the name Cyprus-Mail).

Click here to change your cookie preferences