Whether Mutuum Finance (MUTM) will hit double digits by Q3 2026 is increasingly surfacing across crypto news as presale metrics accelerate and development milestones become clearer. Mutuum Finance has been trading at $0.035 in Phase 6 of its presale, now 98% filled, while capital inflows continue rising despite uneven conditions across the broader crypto market.

Since the presale began, Mutuum Finance has raised $19,500,000 and onboarded 18,500 holders, reflecting sustained demand. As investors debate what crypto to buy now and the best crypto to buy now for medium term growth, MUTM is being assessed not just as a new crypto coin, but as a DeFi crypto with measurable progress and a defined roadmap.

Mutuum Finance presale

Mutuum Finance has been operating a structured, phase based presale that steadily compresses supply while increasing price levels. The current Phase 6 price of $0.035 represents a 250% increase from the Phase 1 entry of $0.01, illustrating how early participation has already generated paper gains. Phase 6 is selling out fast, and the chance to scoop tokens this cheap is quickly ending, as Phase 7 will introduce a near 20% increase to $0.04. The MUTM launch price is set at $0.06, placing current buyers in position for an estimated 430% upside after launch.

This presale structure has been reinforcing urgency rather than speculation. Investors looking for the best cheap crypto to buy now are responding to the narrowing window, especially as whale sized wallets continue accumulating before the next pricing tier opens. As a result, Mutuum Finance is frequently appearing in discussions around what crypto to invest in ahead of 2026 positioning.

Community incentives have played a complementary role in sustaining momentum. Mutuum Finance has been running a $100,000 giveaway, awarding ten winners with $10,000 worth of MUTM each. This initiative has helped widen participation while maintaining engagement during the final stretch of Phase 6.

Alongside this, the project launched a live dashboard with a leaderboard highlighting the top 50 holders. The recently introduced 24 Hour Leaderboard rewards the top ranked user with a $500 MUTM bonus each day, provided at least one transaction is completed within the 24 hour window. The leaderboard resets daily at 00:00 UTC, ensuring continuous activity and transparency.

Mutuum Finance buy and distribute model

Mutuum Finance has been differentiating itself through its buy and distribute mechanism, which links protocol usage directly to token demand. A portion of protocol fees is allocated toward purchasing MUTM tokens from the open market, which are then redistributed to mtToken holders. This structure has been designed to align user participation with long term token circulation rather than short term emissions.

As platform activity grows, this mechanism could progressively reduce available supply while rewarding active participants, a factor often highlighted when assessing what is the best cryptocurrency to invest in within the DeFi crypto segment.

This approach has been reinforcing the perception of Mutuum Finance as a utility driven protocol rather than a purely speculative asset, particularly for investors evaluating the best cheap crypto to buy now with post launch sustainability in mind.

Mutuum Finance price prediction and historical context

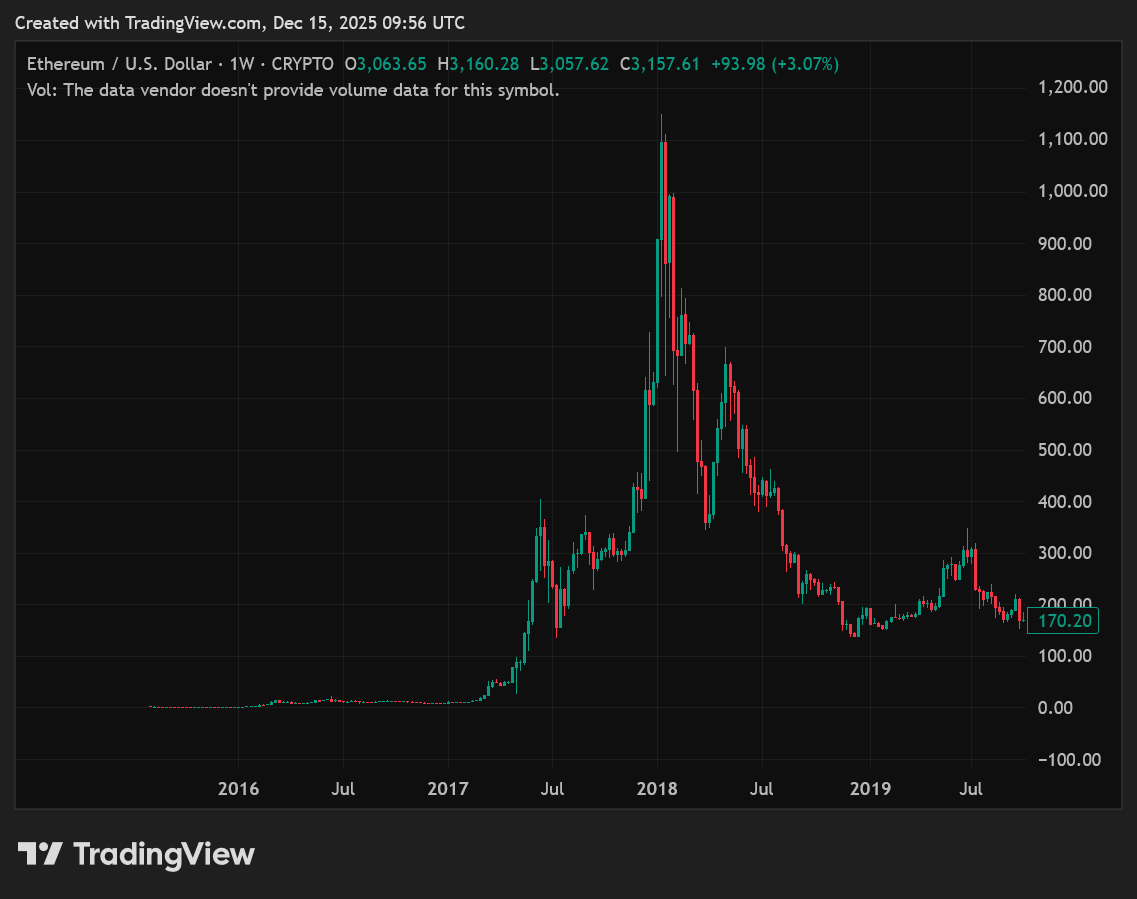

The question of whether Mutuum Finance can reach double digits by Q3 2026 is increasingly being framed through historical analogies. Ethereum’s 2017 to 2018 cycle offers a relevant comparison. ETH traded near $8 in early 2017 before surging to an all time high of approximately $1,420 by January 2018. That move unfolded over roughly 12 months and delivered an ROI of more than 17,000%, driven by rising DeFi experimentation, network adoption, and speculative inflows.

Mutuum Finance is not Ethereum, yet the comparison lies in trajectory rather than scale. MUTM is entering the market at a $0.035 presale price with a defined DeFi use case, a buy and distribute model, and a V1 protocol launch scheduled in 2025. If adoption accelerates post launch and DeFi activity expands into 2026, a move into double digit pricing would require sustained demand, increased protocol fees, and broader market recovery.

From current levels, reaching $10 by Q3 2026 would imply exponential growth, yet historical cycles show that early stage DeFi protocols with working products have achieved outsized returns during expansionary phases. For investors assessing what crypto to buy now with high risk, high reward profiles, Mutuum Finance is increasingly being modeled within that framework.

As speculation gives way to structured analysis, Mutuum Finance is being evaluated less as a short term trade and more as a long horizon DeFi crypto. The combination of presale traction, incentive alignment, and historical context continues shaping its price prediction narrative heading into 2026.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER – “Views Expressed Disclaimer – The information provided in this content is intended for general informational purposes only and should not be considered financial, investment, legal, tax, or health advice, nor relied upon as a substitute for professional guidance tailored to your personal circumstances. The opinions expressed are solely those of the author and do not necessarily represent the views of any other individual, organization, agency, employer, or company, including NEO CYMED PUBLISHING LIMITED (operating under the name Cyprus-Mail).

Click here to change your cookie preferences