By Savvakis C. Savvides

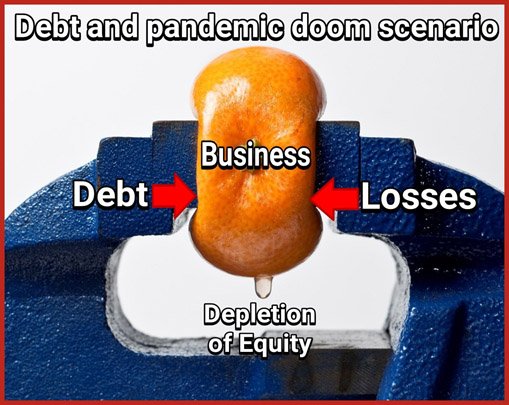

A business today is like an orange that is forcibly squeezed from both sides under conditions of extreme debt and by being obliged to be operating in sub-optimal conditions during the pandemic.

This results in the depletion of equity and renders the capability to undertake new capital investments when the epidemic is over highly improbable. This is the predicament the world finds itself in. A situation that may also lead to a deep and long depression given that domestic demand also suffers as a result.

This is particularly pertinent in Cyprus where conditions of extreme and widely spread private debt existed even before the outbreak of the pandemic. The failure of the current administration to even appreciate what we are up against leads them to implement half measures and even make things worse whereby their myopic policies revolve around the extension of debt by our failing banks.

It is a banking system which, eight years after the bail-in, still cannot tell the difference between collateral lending and a loan being granted primarily on a sound and proper assessment of repayment capability. How can anyone recover from where we seem to be heading slowly but surely? Indeed, do we ever learn from our mistakes?

In the final analysis, I wonder whether anyone in government, or their advisors, even cares to face up to reality and confront the challenges posed by these extraordinary set of events head-on in order to deal with it rather than merely dressing up the window!

Savvakis C. Savvides is an economist, specialising in economic development and project financing. He is a former senior manager at the Cyprus Development Bank and has been a regular visiting lecturer at Harvard University and more recently at Queen’s University, Canada. Author page: https://ssrn.com/author=262460.

Click here to change your cookie preferences